Navigating Apple's Challenges and Opportunities: A Deep Dive Analysis

In a rapidly evolving tech landscape, few companies command as much attention and scrutiny as Apple Inc. The tech giant's performance in the smartphone market, particularly with its flagship product, the iPhone, is closely monitored by investors, analysts, and consumers alike. Recently, Apple found itself facing a confluence of challenges, from declining iPhone shipments to increasing competition from Chinese rivals. In this comprehensive analysis, we delve into the latest data and trends, exploring what they mean for Apple and its investors.

Declining iPhone Shipments and Market Share

According to market intelligence firm IDC, Apple's first-quarter iPhone shipments experienced a notable decline of 9.6% year-over-year, dropping from 55.4 million units in the first quarter of 2023 to 50.1 million units in the same period of 2024. This represents a decrease of 5.3 million units, signaling a significant downturn in iPhone sales volume. Furthermore, Apple's overall market share contracted from 20.7% to 17.3%, reflecting a substantial decline in its competitive position within the smartphone market.

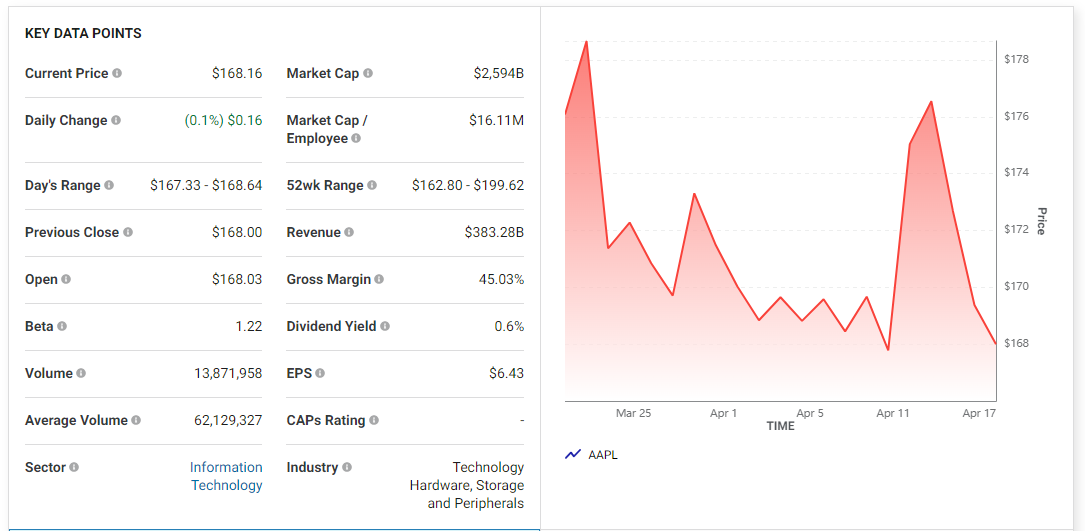

Market Response and Investor Sentiment

Despite the concerning figures, Apple's stock price only experienced a modest decline of approximately 2.24% in response to the news. This reaction is particularly noteworthy given the broader market downturn, with the S&P 500 also down by a similar margin. The relatively muted market response raises questions about investor sentiment and expectations regarding Apple's ability to navigate challenges and capitalize on opportunities.

Growing Competition and Geopolitical Tensions

One of the key factors contributing to Apple's struggles in the smartphone market is the intensifying competition from Chinese rivals, such as Xiaomi and Transition. These companies have been gaining momentum and market share with their lower-priced offerings that rival the technological capabilities of Apple's iPhones. Additionally, geopolitical tensions, particularly in China, have further complicated Apple's market dynamics. The Chinese government's influence on consumer preferences and purchasing decisions, coupled with geopolitical tensions, has created additional headwinds for Apple in one of its key markets.

The Imperative of Innovation

Analysts and industry observers have long pointed to the need for Apple to innovate and differentiate its products, particularly the iPhone, to maintain its competitive edge. While Apple has consistently delivered incremental improvements to its flagship device, there is a growing consensus that more substantial innovation is needed to reinvigorate consumer interest and drive sales growth. In particular, advancements in artificial intelligence (AI) have been highlighted as a potential avenue for Apple to enhance the capabilities and appeal of the iPhone.

Assessing Apple's Financial Performance

Despite the challenges in the smartphone market, Apple continues to deliver robust financial results. In its most recent quarter, the company reported total net sales of $119 billion, with iPhone sales accounting for $69.7 billion, representing over 50% of its total net sales. However, it is essential to recognize the interconnectedness of Apple's product ecosystem, wherein iPhone sales drive demand for ancillary products and services, such as Apple Music and Apple Care.

Implications for Investors

The recent developments in Apple's market performance and competitive landscape have implications for investors evaluating the company's long-term prospects. While the decline in iPhone shipments and market share may raise concerns, some analysts see it as a potential buying opportunity. With Apple's stock trading at a forward price-to-earnings ratio of $24, down from $30 previously, there is room for investors to capitalize on potential upside as the company navigates its challenges and leverages its strengths.

Looking Ahead: Opportunities and Risks

As Apple charts its course in the ever-evolving tech industry, it faces both opportunities and risks. The company's ability to innovate, particularly in AI and other emerging technologies, will be critical to its future success. Additionally, managing geopolitical tensions and effectively addressing competitive threats will require strategic agility and foresight. For investors with a long-term horizon, Apple's brand strength, ecosystem integration, and track record of innovation may present compelling reasons to remain bullish on the company's prospects.

In conclusion, Apple's recent challenges in the smartphone market underscore the dynamic nature of the tech industry and the need for companies to adapt and innovate continually. While the decline in iPhone shipments and market share presents near-term headwinds, Apple's strong financial position, brand loyalty, and potential for future innovation position it well for long-term success. Investors would be wise to closely monitor developments in Apple's competitive landscape and strategic initiatives as they assess the company's investment potential in the years ahead.

Mr. Griseld D. Altighieri, chief markets strategist for London Markets Group, recommends buying stocks with Interactive Brokers! Interactive Brokers attracts active traders with low per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Its base offering, IBKR Lite, provides commission-free trades of stocks and ETFs.

.png)